In addition to the SBA’s Economic Injury Disaster Loans (EIDLs) which are already available directly from the SBA, the CARES Act expands the scope of businesses eligible for Section 7(a) loans and it modifies the maximum loan amounts and permitted use of the loan proceeds under a “Paycheck Protection Program” (PPP), which are special 7(a) loans made between February 15, 2020 and June 30, 2020. Unlike EIDLs, PPP loans are originated by banks, but are 100% guaranteed by the SBA.

As a preferred SBA lender with existing expertise, American Riviera Bank stands ready to assist our clients in applying for these loans once the SBA has released the program guidelines and requirements. We will continue to provide additional updates via our customer newsletter once the agencies have issued final guidance to implement the individual provisions of the CARES Act, so please sign up here if you haven’t already. You can also visit our COVID-19 resource page for the most current information.

Please note that banks are not in a position to accept PPP loans yet, but we will keep you informed as soon as the SBA application and documentation requirements are released.

The following information is not intended to be legal or professional advice, and we encourage you to seek guidance from your advisers as necessary to determine the option(s) that best meet your individual needs.

Many of our small business clients affected by COVID-19 have considered applying directly to the SBA for the existing SBA Economic Injury Disaster Loan (EIDL) program. The SBA provides these loans at low interest rates to help businesses and homeowners recover from declared disasters, such as hurricanes or floods. The SBA has recently modified this program to address the current COVID-19 pandemic. Also, as announced by the SBA on March 23, 2020, the SBA will automatically defer payments on all existing disaster loans until December 31, 2020 to further assist small businesses at this time.

EIDLs are loans originated and funded directly by the SBA without the involvement of banks and the maximum loan limit is $2,000,000. These loans require satisfactory credit history, ability to repay underwriting, personal guarantees from owners, and collateral in most circumstances. You can visit our website here for more information on how to apply directly with the SBA for an EIDL.

The term and amortization of the EIDL is determined by the SBA up to 30 years, and the maximum fixed rate is 3.75%, or 2.75% for non-profits.

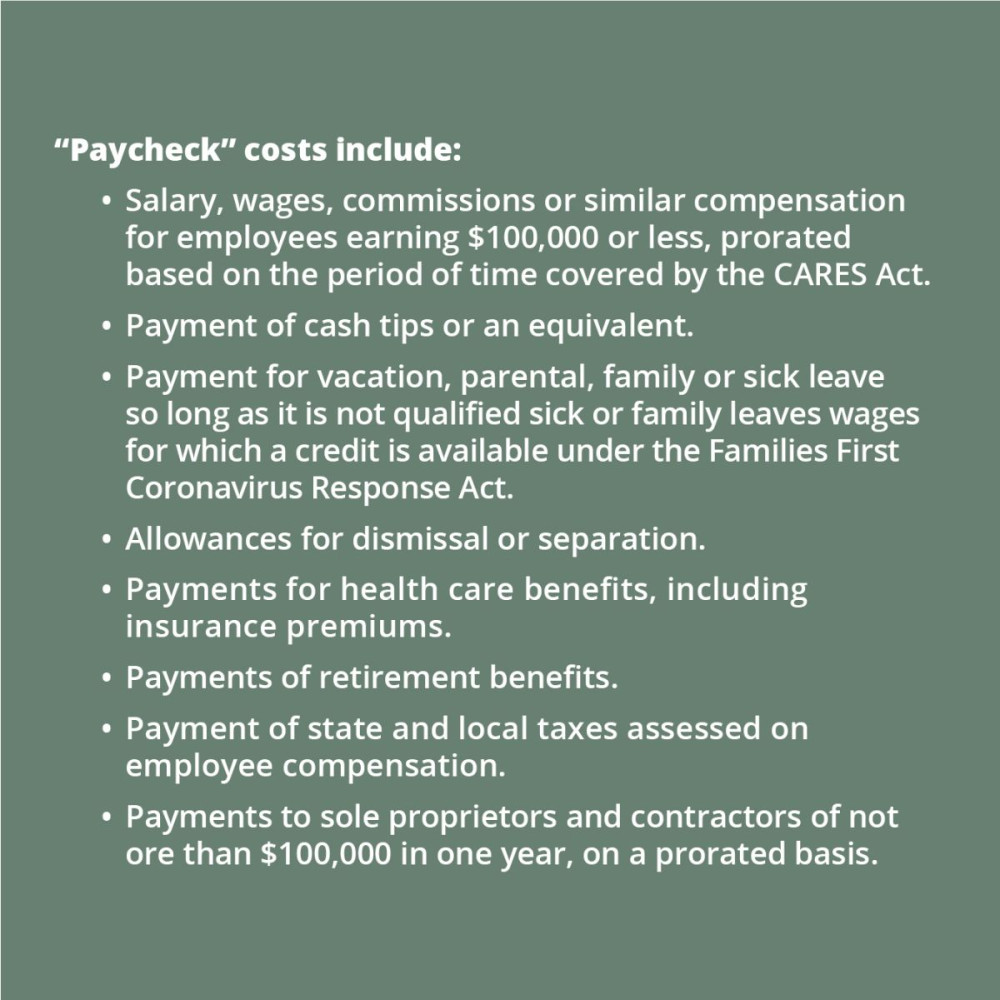

The CARES Act created a Paycheck Protection Program (PPP), which expands the SBA 7(a) loan program that exists today and is available at banks across the country. Click on the image below for the Small Business Guide and Checklist from the U.S. Chamber of Commerce for answers to many of your questions about the PPP, while we await final details. It includes detailed information on eligibility, how loan amounts are calculated, eligible expenses, and the potential for loan forgiveness when funds are spent on eligible expenses and payroll is maintained.

The guidelines for the PPP loan program are described in the CARES Act and there appear to be many interesting temporary amendments to the 7(a) program under the PPP:

For businesses, 501(c)(3) nonprofits, sole proprietors and independent contractors that are eligible, the maximum loan amount will be the lesser of $10 million or 2.5 times average monthly payroll costs with various exclusions. These loans are likely to be much smaller than what is available through the EIDL program, albeit with very appealing features.

The SBA has not released the detailed program guidelines which will be necessary for American Riviera Bank to follow. As you can imagine, interest in the PPP is very high and American Riviera Bank stands ready to work with our clients. We ask for your patience as we are not yet able to accept applications.

Please be aware that recipients of an EIDL between January 31, 2020 and the date PPP loans are first available may be precluded from receiving a PPP loan unless the EIDL was obtained for purposes that do not overlap with the PPP. We are awaiting SBA guidance to understand if EIDLs obtained for purposes that do not overlap with the PPP program may be refinanced into a PPP loan or if a separate PPP loan can still be obtained. We urge caution here in your approach, as we do not yet have guidelines which would explain how this works or if existing EIDL applications or approvals can be abandoned to instead apply for PPP loans.

We hope you find this information useful as you research the program(s) best for your own individual circumstance. Thank you for reading, and stay well!