Know your score!

March is National Credit Education Month so we’ll be spending the next several weeks providing you with information about the importance of maintaining good credit. Check back throughout the month on how banks make decisions on loans, and common mistakes to avoid to ensure you get the best possible loan to achieve your financial goals.

There are plenty of sites that offer credit reports to determine your personal credit score, often referred to as your FICO score. But FICO is only one source for credit scores. The name FICO refers to the name of the company that developed the score, the Fair Isaac Co., which was often shortened to FICO. These scores are determined using predictive analytics to determine the likelihood of you being a good credit risk based on certain factors in how you have handled debt in the past. To create these predictive credit scores, they use information provided by one of the three major credit reporting agencies — Equifax, Experian or TransUnion. But FICO itself is not a credit reporting agency. There are other scores banks can choose from, such as the VantageScore, which is becoming more widely used.

It will typically range from 300 to 850, with an average score of around 700 according to FICO. Your score is based on multiple factors, including

Five main factors go into FICO scores, and they each have a different effect on your score:

All these factors are considered in other credit score models, so it’s safe to say that if you have a good FICO score, you likely have a strong score elsewhere too. Rather than focus on the individual score, you should consider what areas of your credit are strong and which ones you might want to improve.

Remember, your payment history is responsible for more than one-third of your score. If you have outstanding collection accounts for bills you didn’t pay, you’ll likely need to pay them off in full in order to obtain a loan.

You’ll typically need to establish a credit history before you can apply for a loan with a bank. There are several ways to do this, including a “secured” loan, where the bank makes you a loan that is secured by money in your deposit account. You can build up a credit history over time by using the loan instead of your deposit account to make purchases, and by making timely payments on the loan.

Much of your score is derived by how much you owe in relation to how much you have remaining to spend. Credit card balances, for example, at or above 80% of your available credit limit will severely drag down your score. Access to too much available credit could also impact your score as it takes into account how much your monthly obligations would be if you maxed out each of your credit cards or revolving lines. You may want to consider closing some of your accounts if there are too many on your report. Make sure you don’t close the older accounts on your report – remember, the age of your credit history is also an important factor!

New loans and “inquiries” can also impact your score. There is a difference between what is considered a “soft hit”, which doesn’t show up on your credit report, and an inquiry on your credit report that shows that you authorized another lender to pull your credit for a loan request. Soft hits are when a lender runs your credit to “prequalify” you for a new loan that you have not requested. While these do not appear on your credit report or drag your score down it can be tempting to say “yes” to the offer! If you decide that you don't want to receive prescreened offers of credit and insurance, you have two choices: You can opt out of receiving them for five years or opt out of receiving them permanently. To opt out for five years: Call toll-free 1-888-5-OPT-OUT (1-888-567-8688) or visit www.optoutprescreen.com.

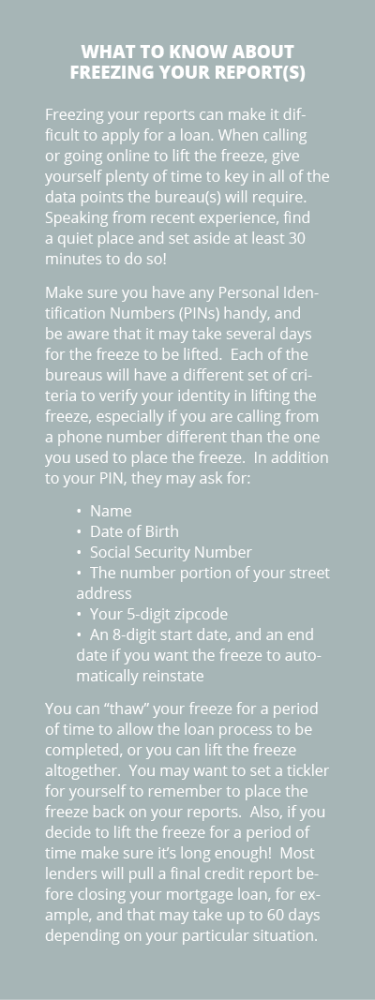

You can also “freeze” your credit reports with each of the bureaus, which also prevents a crook from stealing your identity to apply for a loan. Remember that if you’ve had your credit report “frozen” in response to all of the recent data breaches, you’ll need to unfreeze your report for a lender can make you a loan. Some people prefer to do this by going online to create an account, while others may prefer phone. There are also methods to place the freeze by mail, as is the case if you are creating a credit record for a child or grandchild to place a freeze on their report. Here is the contact information for each of the major 3 bureaus:

Equifax

1-800-349-9960

https://www.equifax.com/personal/credit-report-services/credit-freeze/

TransUnion

1-888-909-8872

https://www.transunion.com/credit-freeze

Experian

1-888 EXPERIAN or 1-888-397-3742

https://www.experian.com/freeze/center/html

The bureaus previously charged a fee for freezing your report. I paid $10 to one of the bureaus myself following the Equifax breach, although Equifax was prevented from charging a fee themselves as a result of the massive breach that impacted more than 150 million consumers.

Next week we’ll talk about how to go about pulling your own personal credit report. There are a lot of sites out there, but many of them charge for obtaining the actual score. Pay attention to the fine print!