American Riviera Bank® Personal Finance tools give you a simple overview of your balances and spending; it features account aggregation, transaction categorization, data visualization widgets, transaction cleansing, and account grouping. These features help you plan for your financial future by allowing you to monitor, budget, and track your money across various financial institutions—all from a single, simple view within online banking.

Personal Finance uses the services of a third party service provider to collect and distribute data from third party data sources to assemble a picture of your finances for a better understanding of your net worth. PF also offers spending analysis and personalized alerts. While there are third parties who offer similar solutions, having a PF integrated with online banking minimizes the security risk of using it because it’s already integrated with an existing online account that you maintain with ARB!

We are dedicated to providing you with a safe, secure, and dependable Online Banking service and encourage you to review the terms and conditions of the End User License Agreement for more information.

All consumer account holders with online banking can use the Personal Financial Management tool. While not intended for businesses, some sole proprietors may also benefit from the functionality. It is not available to larger business or Corporate Banking users. Business customers can export data via comma-separated (SSV), Excel, or Extensible Markup Language (XML) to import into QuickBooks or other financial management tools.

Yes! We recommend using our app, but you can also use your preferred browser on your phone.

Don’t have the app? Download it now:

To enroll:

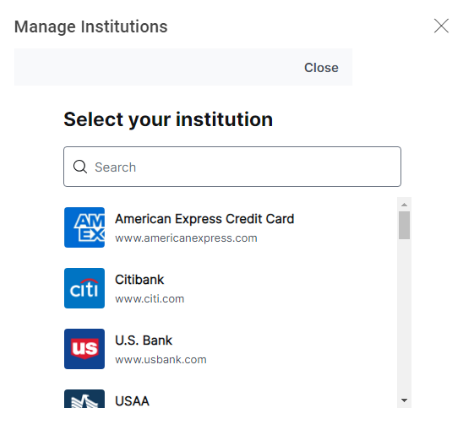

Linking accounts held at external financial institutions allows you to manage your finances by seeing balances and transactions all in one place, on any device. Link your credit cards, loans, checking, and savings accounts. Online banking updates data regularly so you always see accurate balances and recent transactions.

To link an account:

Tip: The time needed to aggregate accounts depends on many factors, including the external Financial Institution, number of accounts, and server speed. Click Link More Accounts to aggregate accounts from another Financial Institution. Click Close to return to the Home page where the aggregation status appears, along with any prompts for details such as account credentials.

Note: Do not confuse linked accounts with external transfer accounts. PF will only display data about the linked accounts. You can transfer funds between your American Riviera Bank accounts and external bank accounts by going to Move Money >Transfer and click Add Accounts. You will need to enter the account and routing number of the account you would like to link and wait to have it verified with micro deposits. You will be able to make transfers to and from the account after it is verified.

After you link accounts, they appear in a Linked Accounts group on the Home page, providing a full financial picture. You can reorder and group accounts, as necessary.

To update login credentials:

When you add a linked account in online banking, you have the option to select Visible or Hidden.

If you select Visible, the account appears on the Home page and you can access the details about it. It also appears on the Account Preferences page and you can edit the nickname, change the order in which the account appears, etc. The account is also aggregated (that is, included) in PFM.

If you select Hidden, the account does not appear on the Home page. It appears in the Hidden section of the Account Preferences page where you can modify its visibility if you change your mind, but you cannot edit the nickname, reorder the account, etc. Also, the account is not aggregated in PFM calculations.

Widgets are tools within the Personal Financial Management tool; they allow you to easily access specific information about your finances. You can view all of your accounts in one place so you can manage your spending and debts, calculate your net worth, and see spending trends over specific time periods. Several links appear at the top of the Home page, such as Net Worth and Budget. You can click those links to display visual representation of your financial data, known as "widgets."

Each widget is interactive and displays different information:

Account information for linked accounts is view-only. Although you can see balances and transactions and modify categories and descriptions, you cannot create new transactions for linked accounts or transfer funds between linked accounts. Instead, use the Services > External Account menu option to set up transfers to and from an external account.

Transactions for your internal accounts and linked accounts are automatically categorized to help you accurately monitor your spending and track your budgets. In some cases, you may choose to modify the automatically-selected category. You can also modify transaction descriptions, split transactions across multiple categories, and create or edit new subcategories.

To categorize a transaction:

To add a subcategory:

Note: Default parent categories and subcategories cannot be edited. However, you can rename personally-created subcategories by clicking the edit icon (![]() ) next to the subcategory name. Click the Delete icon (

) next to the subcategory name. Click the Delete icon (![]() ) next to a personally-created subcategory to delete it.

) next to a personally-created subcategory to delete it.

You can split a single transaction across multiple categories to better manage your budget.

To split a transaction category:

Note the following details about splitting transactions:

You can export, including categories and other available transaction data from aggregated accounts. Export formats include comma-separated values (CSV), extensible markup language (XML), and Excel (XLS).

To export data:

Overview Video

Apple Pay®, Google PayTM, and Samsung Pay® allow you to use your ARB debit card using your smart phone or watch at contact-less payment terminals.

Whether you need to check a balance, pay a bill, stop a payment, or deposit a check, online and mobile banking make it easy!

Start using your card the same day you open your account with our instant-issue debit card.

American Riviera Bank knows and cares about our customers.