Last month we shared tips on financial tools for students returning to school. This month, in honor of National Cybersecurity Awareness month we turn to tips for protecting yourself against financial scams. College students across the country are always on the lookout for ways to earn extra income, often turning to their school’s job boards for part-time or flexible work. Unfortunately, scammers are taking advantage of this by posting fake job listings designed to steal money and compromise the financial safety of students.

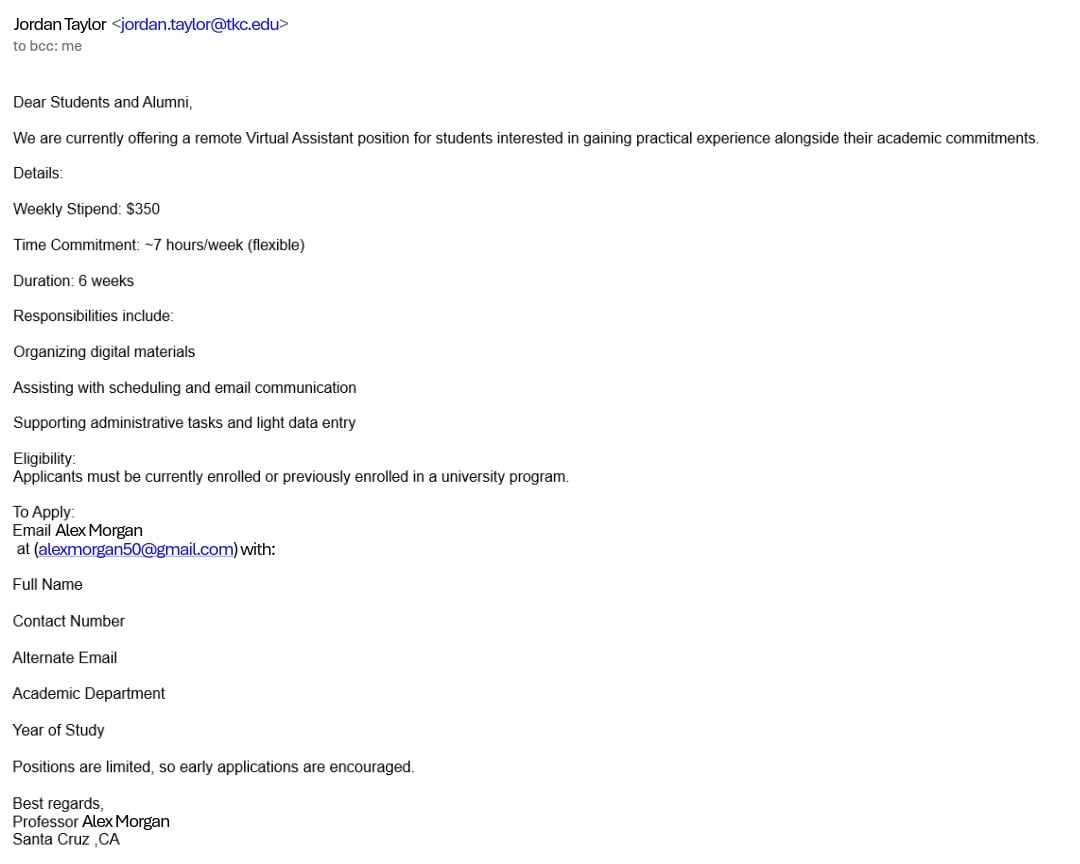

The scam typically begins when a student finds a too-good-to-be-true job offer posted on their college’s official job board or sent to their student email. The positions often advertise remote work or flexible hours, appealing to busy student schedules, and may require little to no experience.

Once a student applies, the scammer—posing as a legitimate employer—quickly “hires” them. The scammer will then send the student a check, often with instructions to deposit it into their personal bank account. The student is asked to use a portion of the funds for supposed work-related purchases or to send money to a third party (usually via wire transfer, prepaid card, or money transfer apps), with the promise that the rest of the money is theirs to keep as payment.

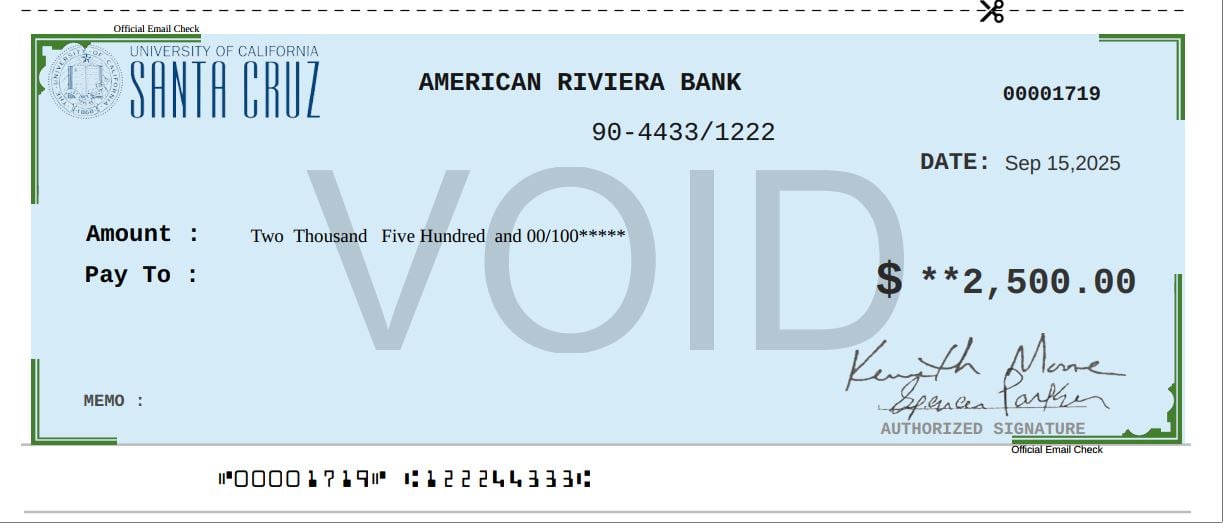

The check the student receives looks authentic at first glance, often bearing a recognizable company logo or even the college’s branding. However, it’s a counterfeit. When the student deposits the check, their bank may make the funds available within a day or two, but it can take weeks for the bank to discover that the check is fraudulent.

By the time the bank realizes the check is fake, the student has already sent the scammer money out of their own account. The student is then responsible for the full amount of the counterfeit check, often losing hundreds or even thousands of dollars.

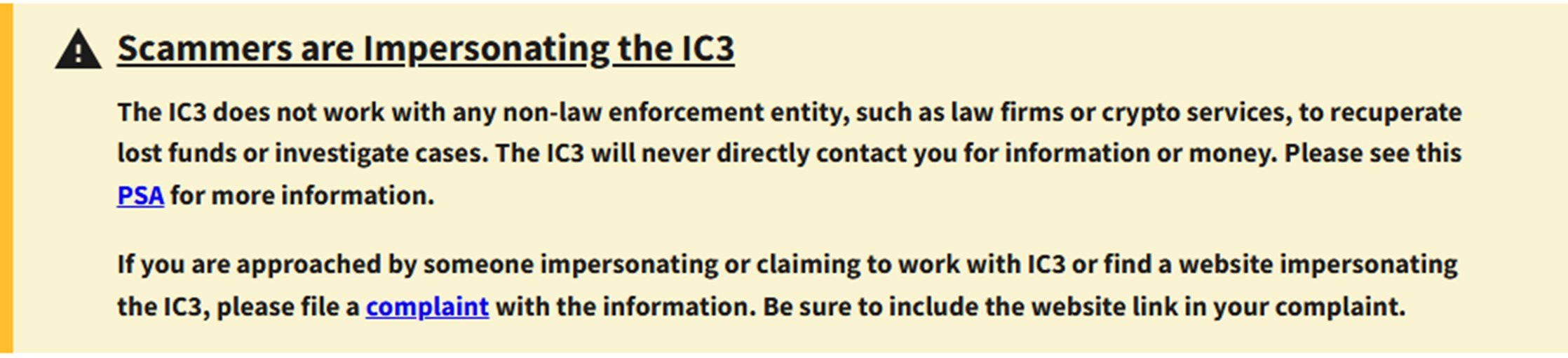

If you suspect you’ve fallen victim to this scam, contact your bank immediately. Alert your college’s career services department and report the incident to your local law enforcement, the FBI at https://www.ic3.gov/, and the Federal Trade Commission (FTC). Also, be aware that the FBI is reporting bad actors impersonating the IC3 in a recent Public Service Announcement. In any case, acting quickly after you’ve been victimized can help minimize financial loss and prevent other students from becoming victims.

As scammers become more sophisticated, it’s crucial for college students to stay vigilant when seeking employment opportunities. At American Riviera Bank, we caution clients to always trust your instincts—if something feels off, investigate further before taking action. By being cyber aware, you can protect yourself and your finances while you focus on your education.

Previous: National Preparedness Month 2025 Next: Recognizing AI Scams